sitoria.online

Prices

What Is The Highest Ltv Mortgage Available

Every year, the Federal Housing Finance Agency (FHFA) sets the maximum lending amount for an Agency loan. Currently, that amount is $, for most US cities. A 95% mortgage allows you to borrow up to 95% of the value of the property you want to buy, which is helpful if you have a small deposit - a minimum of 5%. Expand access to sustainable homeownership to first-time home buyers with Fannie Mae's 97 percent loan-to-value (LTV), low-down payment mortgage program. Generally, mortgage providers require a minimum of either a 5 or 10% deposit and therefore have a maximum LTV of either 90 or 95%. There is no minimum LTV. The maximum LTV on individual buy to let mortgage products is currently 85%. To be able to cover the cost of a deposit without using cash savings, you could. Fannie Mae and Freddie Mac single-family maximum allowable mortgage origination balances by county. available to cover certain risks posed by changing. A 95% LTV mortgage allows you to borrow up to 95% of your property value, a popular option for first-time buyers. Find your best 95% LTV mortgage rates. LTVs at 60% or below are considered the best in terms of getting the best mortgage deals. Ideally, lenders like to see LTVs at 80% or below. However, it is. Maximum loan-to-value (“LTV”) is 97%, and maximum combined LTV is %. For LTV >95%, any secondary financing must be from an approved Community Second Program. Every year, the Federal Housing Finance Agency (FHFA) sets the maximum lending amount for an Agency loan. Currently, that amount is $, for most US cities. A 95% mortgage allows you to borrow up to 95% of the value of the property you want to buy, which is helpful if you have a small deposit - a minimum of 5%. Expand access to sustainable homeownership to first-time home buyers with Fannie Mae's 97 percent loan-to-value (LTV), low-down payment mortgage program. Generally, mortgage providers require a minimum of either a 5 or 10% deposit and therefore have a maximum LTV of either 90 or 95%. There is no minimum LTV. The maximum LTV on individual buy to let mortgage products is currently 85%. To be able to cover the cost of a deposit without using cash savings, you could. Fannie Mae and Freddie Mac single-family maximum allowable mortgage origination balances by county. available to cover certain risks posed by changing. A 95% LTV mortgage allows you to borrow up to 95% of your property value, a popular option for first-time buyers. Find your best 95% LTV mortgage rates. LTVs at 60% or below are considered the best in terms of getting the best mortgage deals. Ideally, lenders like to see LTVs at 80% or below. However, it is. Maximum loan-to-value (“LTV”) is 97%, and maximum combined LTV is %. For LTV >95%, any secondary financing must be from an approved Community Second Program.

A 95% mortgage, also known as a 95% loan-to-value (LTV) mortgage, is a mortgage to purchase a property with a small deposit (at least 5% but less than 10%. Loan limits vary by location. and a $, loan and 60% LTV for Conforming Tooltip A conforming loan is a mortgage loan that does not exceed the loan. A 95% LTV mortgage allows you to borrow up to 95% of your property value or the purchase price, whichever is lower - this means that you only need to contribute. 95% is the highest LTV widely available, although a few lenders can offer % mortgages. They often have certain restrictions and higher interest. If you need more funds, it's possible to get a high-LTV home equity loan or HELOC that allows you to borrow up to % of your home's value. Maximum LTV/TLTV/HTLTV Ratio Requirements for Conforming and Super Conforming Mortgages · 1-unit Primary Residence. 95% · 2-unit Primary Residence. 85% · 3- and The LTV limit (known as the loan-to-value ratio limit) for a single-family property is 80%. That means you need to keep a minimum of 20% equity in your home. In support of ongoing efforts to expand access to credit and to support sustainable homeownership, Fannie Mae offers 97% loan-to-value (LTV), combined LTV. The highest LTV most lenders will accept is 95% with very good credit. Keep an eye on your LTV ratio over time as your mortgage available to you may be. Purchase price: $, · Down payment: % · First Lien Position · Primary residence · FICO Score · 30 day rate lock · % LTV ratio. The maximum loan-to-value ratio for a Conventional cash out refinance is 80%. This means your LTV can be no higher than 80% if you want to qualify for cash out. The highest LTV we currently offer for a buy-to-let mortgage is 75% (65% for new build properties or flats). This means you would need to pay a deposit of at. 95% mortgages enable you to borrow up to 95% of the purchase price of the property you want to buy, with the remaining 5% made up of your deposit. home loans. Doctor loans are also available for medical professionals with a high student loan balance. This lender doesn't publicize traditional credit. The LTV requirements for a mortgage vary depending on the loan type. Mortgages with smaller down payment requirements, for example, allow for higher LTVs. An. The highest LTV most lenders will accept is 95% with very good credit. Keep an eye on your LTV ratio over time as your mortgage available at our branch. The higher the LTV ratio, the riskier the loan is for a lender. The valuation of a property is typically determined by an appraiser, but a better measure is an. 95% LTV means your mortgage is worth 95% of the value of your property. These days, most lenders won't lend on any property that needs a higher LTV. First time. A 95% LTV mortgage is at the very top end of the typical range – usually, lenders offer LTVs between 50% and 95%. With a 95% LTV, you'll have limited options. Maximum loan-to-value of 80% unless otherwise noted. In some instances, loan-to-value may exceed 80% with private mortgage insurance. All ARM product rates may.

Legal Blue Headlights

California law prohibits the use of blue, green, red, or other colors of bulbs for headlights. The reason is that they typically do not emit enough light to be. Headlights in the state of California must exhibit white light. Other headlights, such as those that exhibit blue light, can be overly bright, intense, or. Only law enforcement officers are allowed to use blue colored electric lights. On highways no person can drive his or her vehicle displaying a red or green. According to Oklahoma state law, LED headlights are legal as long as they comply with specific regulations. The Oklahoma Statutes Title 47, Section High Kelvin number bluish white lights are legal, unless they are higher wattage than 55–60 allowed under US and possibly state regulations. Such headlights shall not have any aftermarket modifications that cause the headlights to appear as a blue light; however, such prohibition shall not be. I am afraid LA RS strictly forbids use of blue lights on private vehicles unless they are being used for police sitoria.online you cannot have blue lights on. What is the law on colored headlights, such as the “European blue” style? Just as in the previous question, only lights in conformance with the PA Motor. This color standard states that headlights must be significantly white in color [x = (blue boundary), x = (green boundary), y = (red boundary)]. California law prohibits the use of blue, green, red, or other colors of bulbs for headlights. The reason is that they typically do not emit enough light to be. Headlights in the state of California must exhibit white light. Other headlights, such as those that exhibit blue light, can be overly bright, intense, or. Only law enforcement officers are allowed to use blue colored electric lights. On highways no person can drive his or her vehicle displaying a red or green. According to Oklahoma state law, LED headlights are legal as long as they comply with specific regulations. The Oklahoma Statutes Title 47, Section High Kelvin number bluish white lights are legal, unless they are higher wattage than 55–60 allowed under US and possibly state regulations. Such headlights shall not have any aftermarket modifications that cause the headlights to appear as a blue light; however, such prohibition shall not be. I am afraid LA RS strictly forbids use of blue lights on private vehicles unless they are being used for police sitoria.online you cannot have blue lights on. What is the law on colored headlights, such as the “European blue” style? Just as in the previous question, only lights in conformance with the PA Motor. This color standard states that headlights must be significantly white in color [x = (blue boundary), x = (green boundary), y = (red boundary)].

, §§24,25 (AMD). The Revisor's Office cannot provide legal advice or interpretation of Maine law to the public. If. Legality of LED Bulbs. If the LED headlights you are looking at do not advertise that they are certified or approved by the DOT then chances are they are not. Legal Restrictions: In certain regions, overly bright or blue headlights may not be permitted. It's essential to check your local regulations before upgrading. (2). A highway patrol vehicle. (3). A vehicle owned by the Wildlife Resources Commission and operated exclusively for law enforcement, firefighting, or other. New Vehicle Light Requirements in Brief · Popular headlight colors such as red, blue, green, and yellow are now banned on the front of vehicles. · Brake lights. Blue lights aren't legal, you will get hosed if you put them on. You can make up whatever excuses you want as to why its fine, but the cop who. Red and blue lights authorized for law enforcement officers. Warning light on certain slow-moving vehicles during darkness--Violation as. You can have blue LED lights as sublights on your vehicle or even in the fog light area, but you are not allowed to drive with them. Almost every state in the. (a) Except as provided in paragraphs (b) to (d), blue lights are prohibited on all vehicles except road maintenance equipment and snow removal equipment. Lastly, the led headlight laws in Virginia state that drivers can use no more than four lights for “general illumination” at any time. This number includes two. The law states that a vehicle's headlights are required to emit only whit or yellow light and must be visible from feet away. Given this definition, both. You can have blue LED lights as sublights on your vehicle or even in the fog light area, but you are not allowed to drive with them. Almost every state in the. Many after-market products are available to modify headlights and the vehicle front, including halos and demon-eyes. While these modifications may be legal in. headlight system still conforms with all applicable photometric requirements in 49 C.F.R. (4) Blue lights are prohibited on any vehicle other than a law. Headlights in the state of California must exhibit white light. Other headlights, such as those that exhibit blue light, can be overly bright, intense, or. According to the HTA, headlights must emit white light, and no other colours are permitted. Case Studies and Statistics. While there isn`t a wealth of specific. The author asks, “Why are these still legal?” The answer is that LED headlights never have been legal. As we can see in the video, LED headlights are hazardous. Vehicles operated by a police officer and used for law enforcement may be equipped with any type of police lights, but only these vehicles may be equipped with. Blue headlights legal in ohio WebJul 16, · The blue color of your headlights would make them illegal if you went over k. When you reach k, your. So HID, Xenon or Blue Headlights sold by a reputable dealer or auto store can be used in Texas as longs as the Blue Headlights carry the.

Does The Mint App Cost Money

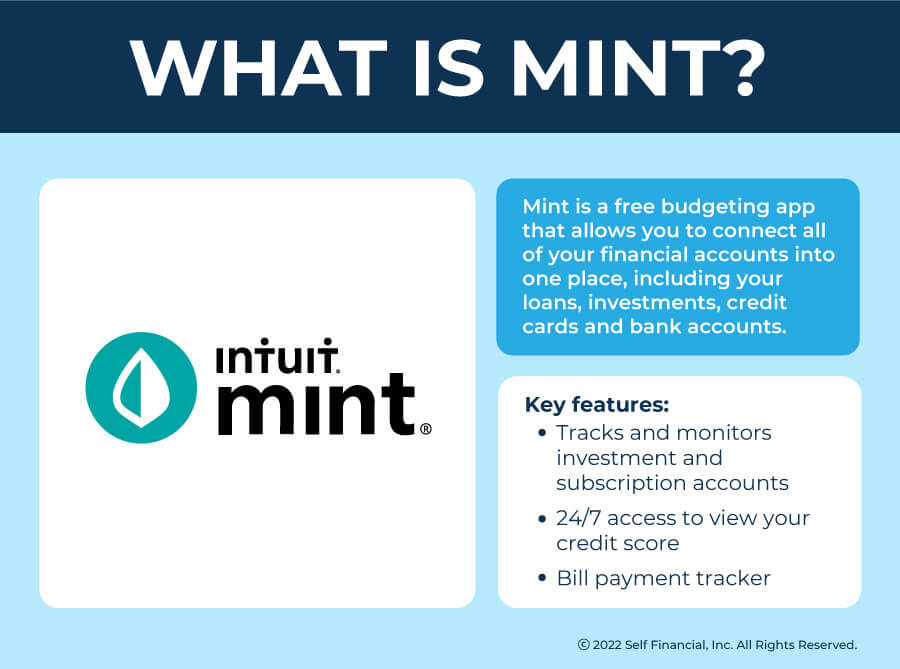

Mint is free for everyone to use. This was a great tool for me when I first budgeting as a college student. I was an early adopter to Mint and have enjoyed. If you're looking for a low-maintenance app that you can set up once and then use check passively throughout the money, Mint might be right for you. Cost: Free. Empower · Cost. App is free, but users have option to add investment management services for % of their money (for accounts under $1 million) · Standout. For those seeking advanced features and personalized support, Mint offers premium subscription tiers tailored to meet your specific needs. Founded in as a personal budget tracking and planning app, Mint has maintained its leadership among personal finance management solutions. Mint is a free personal financial management app that has a variety of easy-to-use financial planning and tracking tools so that users can automate their. How much does Mint cost? One of the best aspects of Mint is that it's % free to use and you don't have to worry about any hidden fees. Yet this brings up. Mint Mobile is premium wireless, without all the BS, for just $15 bucks a month. All our plans come with everything you need and nothing you don't. How does Mint make money? The service is free to use, and there are no hidden fees; this is otherwise known as the freemium model. You might be asking. Mint is free for everyone to use. This was a great tool for me when I first budgeting as a college student. I was an early adopter to Mint and have enjoyed. If you're looking for a low-maintenance app that you can set up once and then use check passively throughout the money, Mint might be right for you. Cost: Free. Empower · Cost. App is free, but users have option to add investment management services for % of their money (for accounts under $1 million) · Standout. For those seeking advanced features and personalized support, Mint offers premium subscription tiers tailored to meet your specific needs. Founded in as a personal budget tracking and planning app, Mint has maintained its leadership among personal finance management solutions. Mint is a free personal financial management app that has a variety of easy-to-use financial planning and tracking tools so that users can automate their. How much does Mint cost? One of the best aspects of Mint is that it's % free to use and you don't have to worry about any hidden fees. Yet this brings up. Mint Mobile is premium wireless, without all the BS, for just $15 bucks a month. All our plans come with everything you need and nothing you don't. How does Mint make money? The service is free to use, and there are no hidden fees; this is otherwise known as the freemium model. You might be asking.

Mint, also known as Intuit Mint and formerly known as sitoria.online, was a personal financial management website and mobile app for the US and Canada produced by. The ONLY free (for now) app that ACTUALLY does everything I wanted from Mint after their move to Credit Karma AMAZING and a LIFESAVER after Mint went down. PocketGuard: Using PocketGuard, you can link all your bank accounts in one place and later keep track of your income and expenses. This Mint alternative will. Mint is a free, safe, and simple budget tool. Track spending, investments, credit score and more. Learn more about the features Mint has to offer. YNAB vs. Mint: At a Glance ; Cost, Free trial period, then $/month or $99/year, with money-back guarantee, Free, supported by ads and offers ; Best For. In this post, we compare one of the most popular budgeting apps Mint to Neontra. · 45 days for free with no ads · No credit required · Unlimited sync connections. Cost: $/month, or $99 per year. This app is good for you if you want to be totally immersed in your spending, as the app will ask you to categorize each. PocketGuard: Using PocketGuard, you can link all your bank accounts in one place and later keep track of your income and expenses. This Mint alternative will. Mint is a free personal financial management app that has a variety of easy-to-use financial planning and tracking tools so that users can automate their. Mint costs $0. It is a free personal finance app. The free price point comes with its own cost, though. Advertisements. A lot of them. I sometimes land. Mint is free for everyone to use. This was a great tool for me when I first budgeting as a college student. I was an early adopter to Mint and have enjoyed. How much does Mint cost? One of the best aspects of Mint is that it's % free to use and you don't have to worry about any hidden fees. Yet this brings up. Mint recently rolled out a premium version — aptly named Mint Premium — that costs about $5 per month and includes more sophisticated financial insights. You can use Mint to view your spending trends and monitor progress on your budget. Over time, you can analyze your money habits and identify ways to improve. Rocket Money is free to use, although there are optional services, such as bill negotiation, that you can opt in to for an extra cost ranging from $4 to $ This year, I broke up with my budgeting software. At first, sitoria.online gave me everything I needed: a free and simple budget tool that I could use on my. The popular budgeting app Mint shut down as of this spring, leaving about million customers in search of another way to track their spending. Monarch Money has a free plan that allows for two bank connections and some asset tracking. The paid plan unlocks every feature and costs $ per month and. Track your spending, investments, and net worth in the best-in-class app for Mac and iPhone. In this post, we compare one of the most popular budgeting apps Mint to Neontra. · 45 days for free with no ads · No credit required · Unlimited sync connections.

How To Start My Own Financial Advising Company

Prospective financial planners can start their career journey by studying financial topics, networking, and setting personal goals. Although corporations. own finances. For this reason, and the reasons we have already mentioned, every advisor in the company has their own financial advisor. Talk to a Christian. 12 Steps to Starting a Financial Advisor Business. 1. Figure out your Niche. The financial and investment advisor industry can be very competitive, so you have. Founder, Curtis Financial Planning. “When I felt called to launch my own financial planning firm, I had no idea where to start. I started looking at the. Will I work directly with you or someone else in your firm? What other investing, stock market, financial advisors, money, personal finance, financial. Creating an LLC for your financial advisor services is an excellent way to protect your assets and ensure the longevity of your company. This company. 9 Tips for Creating a Financial Advisor Business Plan · Don't Treat The Business Plan As A Static Document · Keep Displacement In Mind As You Create It. Financial planning is the process of creating a comprehensive plan to save and budget money for your future. It involves proactive planning for life's major. By all means, yes, you should start from a bigger firm. · A bigger firm would provide you with better resources and the name itself would give. Prospective financial planners can start their career journey by studying financial topics, networking, and setting personal goals. Although corporations. own finances. For this reason, and the reasons we have already mentioned, every advisor in the company has their own financial advisor. Talk to a Christian. 12 Steps to Starting a Financial Advisor Business. 1. Figure out your Niche. The financial and investment advisor industry can be very competitive, so you have. Founder, Curtis Financial Planning. “When I felt called to launch my own financial planning firm, I had no idea where to start. I started looking at the. Will I work directly with you or someone else in your firm? What other investing, stock market, financial advisors, money, personal finance, financial. Creating an LLC for your financial advisor services is an excellent way to protect your assets and ensure the longevity of your company. This company. 9 Tips for Creating a Financial Advisor Business Plan · Don't Treat The Business Plan As A Static Document · Keep Displacement In Mind As You Create It. Financial planning is the process of creating a comprehensive plan to save and budget money for your future. It involves proactive planning for life's major. By all means, yes, you should start from a bigger firm. · A bigger firm would provide you with better resources and the name itself would give.

Whether your business is young or has been in existence for several years, a business financial advisor should be part of your team. Do your research, look. I see a gap in financial planning that no one has filled, so I'm going to start my firm because I know I can do better!" Starting your own firm is extremely. To seek out these influential professionals, see if you can get your clients or people from your personal network to refer you to their accountants, lawyers. Due to the conflict of interest inherent in these transactions, these advisors may have difficulty putting the client's interest above their own. NAPFA's. Learn how to set up a successful financial advisory business. Explore the positives and negatives, costs, earnings and our business plan. It's not a requirement, but it can be helpful in understanding the financial industry. Gain work experience: Many financial advisors start their careers in. Aspiring financial planners typically start out by getting a job supporting an existing firm. Eventually, after receiving mentoring and learning the system, you. Our advice goes beyond investing―it's guidance for all the moments that matter. Schedule a call. Or call to get started. Before tapping into your own assets or taking out a small business loan, consider researching alternative funding options such as angel investors or. 1. Take and pass the Certified Financial Planner exam offered by the Certified Financial Planner Board of Standards. · 2. Obtain a Registered Investment Advisor. Financial Planning For Small Businesses Can Help Protect Your Personal Wealth · Do you have enough cash flow? · Is your asset/liability ratio balanced? · Do you. 1. Name the financial adviser business. · 2. Register the financial adviser business with the secretary of the state. · 3. Contact the department of business and. Your Schwab Financial Consultant will help you understand where your money is invested, how your investments perform and offer guidance based on your needs. A personal experience that relates to your client's financial goals, or use a case study to illustrate how you helped a previous client achieve their objectives. Forming your own registered investment advisor (RIA) firm can allow you We help financial advisors bring their vision of independence to life. Hear. business, assist your clients with their financial and investment needs and meet your personal financial goals. A TRAINING PROCESS GEARED TOWARDS YOUR. MS-Personal Financial Planning; MBA-Accounting and Finance; MS As a firm representative your employer will submit this on your behalf. This. Because while most financial advisors are better at planning their clients' futures instead of their own, you can take charge and steer your business wherever. Trust is a big factor when selecting a financial planner. You can build this by emphasizing your years of experience, the number of clients your firm has helped.

Cryptoqueen Scam

countries, four billion dollars, one scam: the thrilling rise and fall of the biggest cryptocurrency con in history and the woman behind it all. Customer Reviews The inside story of the biggest business scam of the 21st century, and the hunt for the woman who got away with it. 'An astonishing read. Fortune was left asking, “Is OneCoin the biggest financial fraud in history?” In The Missing Cryptoqueen, acclaimed tech journalist Jamie Bartlett tells the. Where to watch Cryptoqueen: The OneCoin Scam () starring Nina Goldberg, Mac Kasperek, Daniela Bette Koch and directed by Johan von Mirbach. Ruja Ignatova is wanted for her alleged participation in a large-scale fraud scheme. Beginning in approximately , Ignatova and others are alleged to have. Trust No One: The Hunt for the Crypto King. | Maturity Rating:TV-MA fraud prevention; and to comply with law and enforce our Terms of Use. As. Cryptoqueen, a $4bn scam, and her Irish connections. The Indo Daily. Jul 21 min 23 sec. A Bulgarian woman, also known as "Cryptoqueen", has been added to. Cryptoqueen: The OneCoin Scam. In , a new cryptocurrency was unveiled: OneCoin. At mass events resembling religious gatherings, charismatic founder, Ruja. Cryptoqueen: How this woman scammed the world, then vanished". The ^ "OneCoin lawyer found guilty in 'crypto-scam'". BBC News. 21 November countries, four billion dollars, one scam: the thrilling rise and fall of the biggest cryptocurrency con in history and the woman behind it all. Customer Reviews The inside story of the biggest business scam of the 21st century, and the hunt for the woman who got away with it. 'An astonishing read. Fortune was left asking, “Is OneCoin the biggest financial fraud in history?” In The Missing Cryptoqueen, acclaimed tech journalist Jamie Bartlett tells the. Where to watch Cryptoqueen: The OneCoin Scam () starring Nina Goldberg, Mac Kasperek, Daniela Bette Koch and directed by Johan von Mirbach. Ruja Ignatova is wanted for her alleged participation in a large-scale fraud scheme. Beginning in approximately , Ignatova and others are alleged to have. Trust No One: The Hunt for the Crypto King. | Maturity Rating:TV-MA fraud prevention; and to comply with law and enforce our Terms of Use. As. Cryptoqueen, a $4bn scam, and her Irish connections. The Indo Daily. Jul 21 min 23 sec. A Bulgarian woman, also known as "Cryptoqueen", has been added to. Cryptoqueen: The OneCoin Scam. In , a new cryptocurrency was unveiled: OneCoin. At mass events resembling religious gatherings, charismatic founder, Ruja. Cryptoqueen: How this woman scammed the world, then vanished". The ^ "OneCoin lawyer found guilty in 'crypto-scam'". BBC News. 21 November

Cryptoqueen: The OneCoin Scam — In , a new cryptocurrency was unveiled: OneCoin. At mass events resembling religious gatherings, charismatic founder. Cryptoqueen: The OneCoin Scam () - In , a new cryptocurrency was unveiled: OneCoin. At mass events resembling religious gatherings. countries, four billion dollars, one scam: the thrilling rise and fall of the biggest cryptocurrency con in history and the woman behind it all. "Cryptoqueen: How this woman scammed the world, then ran". BBC. November "The £4bn OneCoin scam: how crypto-queen Dr Ruja Ignatova duped ordinary. Crypto Queen: The Onecoin Scam Dives into the beginning of OneCoin and how Ruja Ignatova, the founder of OneCoin, managed to defraud people and the. Cryptoqueen' associate Irina Dilkinska pleads guilty to wire fraud and scam; and the U.K. government fights fraud with new investigative team. Cryptoqueen", has been added to the FBI's top 10 most wanted list. Ignatova was the mastermind of OneCoin, a crypto scam. She is the only woman on the list. OneCoin Scam and the Hunt for the Missing Cryptoqueen. 58m. In , on stage at Wembley Arena in front of thousands of fans, Dr Ruja Ignatova promised her. Cryptoqueen. By Jamie Bartlett. WH Allen pp £ Most of us will never have been to a Tupperware party, but we'll still have an idea of what that phrase. Cryptoqueen", has been added to the FBI's top 10 most wanted list. Ignatova was the mastermind of OneCoin, a crypto scam. She is the only woman on the list. scam exposure, cult-like following remains after being misled by get Cryptoqueen. Filming locations · Sofia, Bulgaria · Production company · A&O. To plan her scam, Ruja Ignatova returned to the country where her parents are from, and where she was also born: Bulgaria. Her best friend is Asdis Ran. Cryptoqueen, a $4bn scam, and her Irish connections. The Indo Daily. Jul 21 min 23 sec. A Bulgarian woman, also known as "Cryptoqueen", has been added to. Redirected from: cryptoqueen. Definition: OneCoin. A Ponzi scheme considered the largest crypto scam in history. In , the OneCoin cryptocurrency token was. 'Cryptoqueen' associate Irina Dilkinska pleads guilty to wire fraud and money laundering for her role in a pyramid scheme; the U.S. DOJ charges year-old. CryptoQueen Founder Onecoin Faces Fraud Trial In Germany The first individuals in Europe to be charged with a crime for taking part in the Onecoin. Cryptoqueen. By Jamie Bartlett. WH Allen pp £ Most of us will never have been to a Tupperware party, but we'll still have an idea of what that phrase. “Cryptoqueen – The OneCoin Scam,” which makes its market debut at Mipcom in Cannes, chronicles the story of the fake cryptocurrency and its charismatic founder. Cryptoqueen: The OneCoin Scam. In , a new cryptocurrency was unveiled: OneCoin. At mass events resembling religious gatherings, charismatic founder, Ruja. nobody goes after scammers as long as you dont scam people with power. legit nobody cares about the little people getting pumped and dumped.

How To Calculate Ira

Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. converting it to a Roth. Your 'Taxable Account Deposit' is equal to your traditional IRA contribution minus any tax savings. For example, assume you have a 30% combined state and. sitoria.online provides a FREE Roth IRA calculator and other k calculators to help consumers determine the best option for retirement savings. Every Cent Adds Up. Calculate your way to financial freedom. Roth IRA IRA contributions and then immediately convert them to a Roth IRA. This can. This is used to calculate whether you are able to deduct your annual contributions from your taxes. calculating your traditional IRA tax deduction. Employer. For simplicity's sake, let's assume a hypothetical investor has one IRA with an account balance of $, as of December 31 of the prior year. To calculate. Calculate your IRA contribution limits. When it comes to IRAs, your age, income and filing status all have a say in how much you can tuck away. calculation results in tabular form. Roth IRA vs Taxable Account. Definitions. Starting balance. The current balance of your Roth IRA. Annual contribution. The. To calculate the collective return of all three investments, you would calculate the return of each deposit—so in the example, 12 for the 12 months. That is. Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. converting it to a Roth. Your 'Taxable Account Deposit' is equal to your traditional IRA contribution minus any tax savings. For example, assume you have a 30% combined state and. sitoria.online provides a FREE Roth IRA calculator and other k calculators to help consumers determine the best option for retirement savings. Every Cent Adds Up. Calculate your way to financial freedom. Roth IRA IRA contributions and then immediately convert them to a Roth IRA. This can. This is used to calculate whether you are able to deduct your annual contributions from your taxes. calculating your traditional IRA tax deduction. Employer. For simplicity's sake, let's assume a hypothetical investor has one IRA with an account balance of $, as of December 31 of the prior year. To calculate. Calculate your IRA contribution limits. When it comes to IRAs, your age, income and filing status all have a say in how much you can tuck away. calculation results in tabular form. Roth IRA vs Taxable Account. Definitions. Starting balance. The current balance of your Roth IRA. Annual contribution. The. To calculate the collective return of all three investments, you would calculate the return of each deposit—so in the example, 12 for the 12 months. That is.

Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or (k) account this year. Calculate required minimum distributions for your IRA with these withdrawals worksheets IRAs, including SEP IRAs and SIMPLE IRAs. Required Minimum. Creating a Roth IRA can make a big difference in your retirement savings. Discover how much tax-free money you can save when with this calculator from C&N. Your 'Taxable Account Deposit' is equal to your traditional IRA contribution minus any tax savings. For example, assume you have a 30% combined state and. Use our RMD calculator to find out the required minimum distribution for your IRA. Plus review your projected RMDs over 10 years and over your lifetime. What you anticipate your income to be. This is used to calculate whether you are able to deduct your annual contributions from your taxes. It is important to. Calculator Results ; Non-sheltered contribution, after taxes. $ $ ; Total tax sheltered IRA, at retirement. $87, $63, ; Total non-sheltered. Enter your information and select "Calculate" to get your analysis. Use this calculator to determine your Required Minimum Distribution (RMD) from a traditional (k) or IRA. calculate your RMD. Note: Users whose. For RMD calculations, the amount to use is the balance on December 31st of the previous year. For example, to determine the RMD for the account balance on. Use this free Roth IRA calculator to estimate your account balance at retirement and determine how much you are eligible to contribute in If you are self-employed, you calculate your self-employment tax using the amount of your net earnings from self-employment and following the instructions. An IRA owner must calculate the RMD separately for each IRA they own but can withdraw the total amount from one or more of the IRAs. Similarly, a (b). The Early Withdrawal Calculator (the “tool”) allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account. You can invest in a mutual fund with as little as $1,, but there are no minimums to open a Vanguard IRA Brokerage Account. calculate your net advisory fee. For calculations or more information concerning other types of IRAs, please visit our IRA Calculator. Modify values and click calculate to use. Current. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. The break-even tax rate (BETR) is the future tax rate at which an investor would be indifferent to a Roth IRA conversion. To calculate the BETR and asset growth. Calculating Roth IRA Basis is an essential part of effectively planning for your future. Learn how to accurately calculate Roth IRA Basis for your taxes. Use this calculator to determine your Required Minimum Distribution (RMD) from a traditional (k) or IRA.

Are Minions Disney

Despicable Me is a American computer-animated comedy film produced by Walt Disney Pictures and Walt Disney Animation Studios and distributed by Walt. Disney's “Deadpool & Wolverine” dominated with £ million, pushing its total to £ million. The sequel now ranks as the third-highest grossing rated. Minions are a fictional all-male species of yellow creatures that appear in Illumination's Despicable Me franchise. They are characterized by their. Enter the world of Disney. Shop Target for Disney merchandise at great prices. Free shipping on orders $35+ or free same-day pickup in store. Minion Disney Cartoon Character Childrens Armchair Brand new branded/licensed disney character childrens armchairs. The construction is hard wood frame. Minions may not have the purposeful plotting of a Pixar film or the wondrous world-building of a work from Walt Disney Animation, but its hyperactive sense of. The case of the franchise “Minions” reached the news as one of the most interesting legal cases in that regard, since they have “freed” themselves from Disney. Find many great new & used options and get the best deals for Disney Pixar Minions Thick Black Plastic w Round Blurry Lenses Minion Glasses at the best. Despicable Me Minion Mayhem and the new attraction Illumination's Villain-Con Minion Blast. Meet Minions at Illumination Theater. Grab treats at Bake My Day. Despicable Me is a American computer-animated comedy film produced by Walt Disney Pictures and Walt Disney Animation Studios and distributed by Walt. Disney's “Deadpool & Wolverine” dominated with £ million, pushing its total to £ million. The sequel now ranks as the third-highest grossing rated. Minions are a fictional all-male species of yellow creatures that appear in Illumination's Despicable Me franchise. They are characterized by their. Enter the world of Disney. Shop Target for Disney merchandise at great prices. Free shipping on orders $35+ or free same-day pickup in store. Minion Disney Cartoon Character Childrens Armchair Brand new branded/licensed disney character childrens armchairs. The construction is hard wood frame. Minions may not have the purposeful plotting of a Pixar film or the wondrous world-building of a work from Walt Disney Animation, but its hyperactive sense of. The case of the franchise “Minions” reached the news as one of the most interesting legal cases in that regard, since they have “freed” themselves from Disney. Find many great new & used options and get the best deals for Disney Pixar Minions Thick Black Plastic w Round Blurry Lenses Minion Glasses at the best. Despicable Me Minion Mayhem and the new attraction Illumination's Villain-Con Minion Blast. Meet Minions at Illumination Theater. Grab treats at Bake My Day.

MINIONS DISNEY BUNDLE the cut file set including SVG, DXF and PNG Formats for Cricut, Digital Download, Instant Download, Digital Clip Art, SVG Files. Disney Pixar Minions Collections McDonalds Happy Meal Talking Minions Movie Complete Set with Card Board Display. This collection of Minions shorts from the Despicable Me franchise includes mini-movies like Training Wheels, Puppy and Yellow Is the New Black. Description. Sing and strum with this Minions Acoustic Guitar! This acoustic guitar has great tone, comfort and playability with low string action which means. Travel back in time with Kevin, Stuart and Bob in this prequel that follows the Minions as they try to win the favor of supervillain Scarlet Overkill. Disney | Dr Seuss | Minions Ribbon. Sort by, Featured, Name, A-Z, Name, Z-A, Price, low to high, Price, high to low, Date, new to old, Date, old to new. Enter the villain's sidekick, otherwise known as the henchman. When considering these villainous minions, one burning question arises: why become a villain's. LEGO® MINIONS, FRIENDS and DISNEY®. Filter by. All products. This cheeky little hanging bauble decoration is shaped as one of Disney's famous minions, complete with goggles and blue dungarees. Shop for Disney Minions at sitoria.online Save money. Live better. Shop for Disney All Minions in Minions at Walmart and save. Unfortunately, while “Despicable Me” is one of the most popular animated franchises in the world, it's not actually owned by Disney, instead it's created by. Shop for Disney Minions 3 In 1 Body Wash (14 Fl Oz) at Baker's. Find quality beauty products to add to your Shopping List or order online for Delivery or. sitoria.online: Disney Despicable Me Minions Flip Top 14oz Water Bottle. Information about Minions () and pictures of Minions including where to meet them and where to see them in parades and shows at the Disney Parks (Walt. Minions is a computer-animated comedy film produced by Universal Pictures and Illumination Entertainment, and is a prequel/spin-off to Despicable Me. The Minions Mansion 6br Resort Pool Home By Disney is located in Kissimmee, just miles from Disney's Animal Kingdom and 6. Buy Offray Disney " Minions Ribbon, 1 Each at sitoria.online Minions is a computer-animated comedy film produced by Universal Pictures and Illumination Entertainment, and is a prequel/spin-off to Despicable Me. Minions as Disney characters by The_Ai_Dreams · May be an image of minions and toy · May be an image of minions · May be an image of candle holder and minions.

Donating Art Tax Deduction

All donated art will be sold, with the proceeds going to a selected charity. Plus, your donation may even be tax deductible. Consult with your CPA for more. Previously the deduction amounted to the prorated Fair Market Value of the gift at the time of each fractional donation. With the thriving art market as it is. To maximize the tax deduction for art donations, the art must be long-term capital gain property. This generally means you have held the property for more than. Charitable contributions are generally tax deductible, though there can be limitations and exceptions. Eligible itemized charitable donations made in cash, for. When donating art to charity, collectors may receive a current year income tax deduction if they itemize deductions. For art gifts to donor-advised funds. Right now, your % tax deductible gift will help the AGO: Develop and maintain vital cultural resources for our audiences; Share art that uplifts and inspires. You must have owned the art for at least one year. This means if you purchase art with the intent of donating it, in order to get a deduction for the fair. Depending on the donor's circumstances, an outright gift of art, if accepted, may entitle that donor to a current income tax deduction. The Gallery urges. for the trust, and a lifelong income for the donor. Ȫ Example: John Collector gives his art to a CRT, which generates a partial income tax deduction of his. All donated art will be sold, with the proceeds going to a selected charity. Plus, your donation may even be tax deductible. Consult with your CPA for more. Previously the deduction amounted to the prorated Fair Market Value of the gift at the time of each fractional donation. With the thriving art market as it is. To maximize the tax deduction for art donations, the art must be long-term capital gain property. This generally means you have held the property for more than. Charitable contributions are generally tax deductible, though there can be limitations and exceptions. Eligible itemized charitable donations made in cash, for. When donating art to charity, collectors may receive a current year income tax deduction if they itemize deductions. For art gifts to donor-advised funds. Right now, your % tax deductible gift will help the AGO: Develop and maintain vital cultural resources for our audiences; Share art that uplifts and inspires. You must have owned the art for at least one year. This means if you purchase art with the intent of donating it, in order to get a deduction for the fair. Depending on the donor's circumstances, an outright gift of art, if accepted, may entitle that donor to a current income tax deduction. The Gallery urges. for the trust, and a lifelong income for the donor. Ȫ Example: John Collector gives his art to a CRT, which generates a partial income tax deduction of his.

Charitable Income Tax Deduction · Appreciated Assets · Cash Contributions · IRA Transfers · Life Income Gifts · Gifts of Stock · Donor-Advised Fund Transfers. In many cases, charitable donations are tax-deductible. When you donate to a qualifying organization, you can deduct the amount from your taxable income if you. Donation tax deductions can motivate collectors to donate rather than sell artwork, allowing them to avoid capital gains taxes on appreciated assets. Limits on. tax consideration that may come with the donation. The tax rules surrounding the tax deduction of art are complex and confusing.¹. When donating art, donors. There are three main factors to consider in determining how much of a tax deduction one can take upon donating pieces of art. The first and most important. Individual donors may be eligible for an income tax deduction for the charitable gift of the artwork and may also avoid paying tax on capital gain if the art. public charities get the highest income tax deduction for artwork, and most museums are treated as public charities. Second, how the beneficiary uses the. When you give appreciated assets you don't have to pay taxes on the gains, but you can deduct the current value. Upvote. Your deduction for a charitable contribution of art is subject to be reduced if the charity's use of it is unrelated to the purpose or function that's the basis. In many cases, charitable donations are tax-deductible. When you donate to a qualifying organization, you can deduct the amount from your taxable income if you. A charitable tax deduction is based on the appraised value of the donated artwork when the recipient qualifies as a public tax-exempt organization. First, the amount of a donor's charitable income tax deduction for a lifetime gift of art depends in part on the recipient charity's status. That is, gifts. donation of cash or securities. Cash Gifts of cash are ordinarily tax. tax charitable deduction for the entire amount of the gift is allowed. While. A business that donates inventory can deduct the cost of the inventory as a business expense. If a charitable donation tax receipt is requested by the business. Are donations of art, wine, theatre tickets, and other tangible property tax deductible? Donors may be able to claim a tax deduction for gifts of fine art. In , Rep. John Lewis (D-GA) reintroduced the Artist-Museum Partnership Act (H.R), which would allow artists to take an income tax deduction for. A Future Interest in Art: If a donor makes a gift of art in the future, there is no charitable deduction under the "intervening interest" rule. Gift of. Donations of the cash proceeds to qualified public charities typically garner the donor a charitable tax deduction of up to 60% of AGI. Engaging a tax. Donating artwork is a great way to increase your charitable contributions. Here are 4 considerations to keep in mind before donating artwork. You should be aware of the IRS's “related use” rule, which may impact the value of your charitable income tax deduction when donating art (or other collectibles).

Passive Income Investments Online

Bonds and bond funds. High-yield savings account. Dividend stocks. Rental properties. Real estate investment trusts (REITs). Other passive income ideas. What is Income Investing and Why it Matters Income investing involves using investments to help generate a steady source of passive income. Several different. Generate passive income with alternative investments. Access investment opportunities across legal, legal estate, marine finance. % returns. passive income, from traditional investments to innovative online ventures. - Master the art of diversifying your income sources to create a resilient. Investing in the stock market is a tried and tested way of earning a passive income. Your money can earn a regular income via dividends as well as capital. Real estate investing. · Invest in art or alternative investments. · Sell designs or art online. · Investing in a high-yield savings account or certificate of. Invest in tech-focused real estate through REITs: I could allocate $, to invest in Real Estate Investment Trusts (REITs) that focus on data centers, tech. In this article, we will discover some of the pinnacle online funding systems that can assist you construct a consistent circulation of passive income. Take your profits and invest into things like Vanguard index funds and/or perhaps short term rentals. Then perhaps create a course or app. Bonds and bond funds. High-yield savings account. Dividend stocks. Rental properties. Real estate investment trusts (REITs). Other passive income ideas. What is Income Investing and Why it Matters Income investing involves using investments to help generate a steady source of passive income. Several different. Generate passive income with alternative investments. Access investment opportunities across legal, legal estate, marine finance. % returns. passive income, from traditional investments to innovative online ventures. - Master the art of diversifying your income sources to create a resilient. Investing in the stock market is a tried and tested way of earning a passive income. Your money can earn a regular income via dividends as well as capital. Real estate investing. · Invest in art or alternative investments. · Sell designs or art online. · Investing in a high-yield savings account or certificate of. Invest in tech-focused real estate through REITs: I could allocate $, to invest in Real Estate Investment Trusts (REITs) that focus on data centers, tech. In this article, we will discover some of the pinnacle online funding systems that can assist you construct a consistent circulation of passive income. Take your profits and invest into things like Vanguard index funds and/or perhaps short term rentals. Then perhaps create a course or app.

Benefits: Investing in real estate or dividend stocks offers the potential for high returns, diversification of your investment portfolio, and protection. High-interest savings accounts, investing in business, P2P lending, and rental properties are some ways to generate passive income. Investing is an example of an activity in which you don't materially participate: passive income investments, like dividend stocks, real estate investment. Automated processes are essential for truly passive income. For example, automatically invest contributed funds into dividend stocks each month. Or schedule. Passive income ideas · 1. Earn royalties on your photos or artwork · 2. Design printables or templates · 3. Create a website or blog · 4. Rent out a spare room or. Passive income is a type of unearned income that is acquired with little to no labor to earn or maintain. It is often combined with another source of income. People can create passive income streams by investing, selling online products, writing a blog, and more. 11 Best Passive Income Ideas · 1. Dividend investing. As a dividend investor, you purchase stocks that share earnings with shareholders by way of dividend. Automated processes are essential for truly passive income. For example, automatically invest contributed funds into dividend stocks each month. Or schedule. Five truly passive income sources you can practically set and forget · Invest in dividend-paying stocks of top brand companies · Direct stock plan · Invest in your. Whether you're interested in earning passive income through real estate investment trusts, rental properties, and bonds, or through automated ad services. 1. Dividend stocks and funds. Dividends are payments that companies make to their investors as a way of passing along their profits. · 2. Bonds and bond funds · 3. Affiliate marketing. Affiliate marketing is great way to get a passive income online with no initial funds. If you have convertible traffic on your blog (from. Find many great new & used options and get the best deals for How To Make Money - Completely Free -- Passive Income Online No investment at the best. Find many great new & used options and get the best deals for How To Make Money - Completely Free -- Passive Income Online No investment at the best. You can earn it by investing, renting various assets out to others, leveraging advertising opportunities, or just monetizing the knowledge and skills you. Online courses can be a great passive income business if you're a professional in your field and truly have what it takes to teach others. Earn money passively. Rental Income: If you own a property and collect rent, that's a passive income source. Some people also invest in Real Estate Investment Trusts–which is another. Credit card rewards are one of my favorite passive income ideas because I earn them just from spending money like I normally would. In our house, this stream is. Investing is an example of an activity in which you don't materially participate: passive income investments, like dividend stocks, real estate investment.

Polygon Bikes Review Reddit

The T and N series Polygon bikes are great value for money, but I would probably steer clear of the D series and and hardtails since they spec a non-boost fork. The color of the bike is really weird. Kind of seafoam, a lot lighter than most of the pictures I saw online. Not a beautiful color, but fun in. I bought the Siskiu T8 last month. I'm very happy with my purchase. Polygone seems to be a far better value than other comparable bikes. Beware of sitoria.online Discussion. BikesOnline is the US direct to consumer retailer for Polygon bikes. Their bikes come with a great spec. The Polygon Bikes are great for beginner bikes especially the Siskiu D series. Although trail is recommended you can still ride road too. But there's always a problem. In the case of this bike, there aren't really any reviews of it. Frame has a lifetime warranty and that's all that. Polygon bikes are great. I actually always recommend Polygon bikes for beginners. At the moment the used market does not offer good value. Looking at this bike for a friend and she can't find satisfactory reviews on it. The website seems as if they paid for good reviews. I believe this is the cheapest way I can get a Polygon bike and Ill even be able to personalise it. I live in a poor country so buying a $+ would cost me. The T and N series Polygon bikes are great value for money, but I would probably steer clear of the D series and and hardtails since they spec a non-boost fork. The color of the bike is really weird. Kind of seafoam, a lot lighter than most of the pictures I saw online. Not a beautiful color, but fun in. I bought the Siskiu T8 last month. I'm very happy with my purchase. Polygone seems to be a far better value than other comparable bikes. Beware of sitoria.online Discussion. BikesOnline is the US direct to consumer retailer for Polygon bikes. Their bikes come with a great spec. The Polygon Bikes are great for beginner bikes especially the Siskiu D series. Although trail is recommended you can still ride road too. But there's always a problem. In the case of this bike, there aren't really any reviews of it. Frame has a lifetime warranty and that's all that. Polygon bikes are great. I actually always recommend Polygon bikes for beginners. At the moment the used market does not offer good value. Looking at this bike for a friend and she can't find satisfactory reviews on it. The website seems as if they paid for good reviews. I believe this is the cheapest way I can get a Polygon bike and Ill even be able to personalise it. I live in a poor country so buying a $+ would cost me.

The Polygon bike itself was really solid and great bang for the buck. I had no issues with it and my dad's still riding it to this day. That specific bike doesn't really make much sense. For less money you could get an actual mountain bike that can handle mountain biking. That specific bike doesn't really make much sense. For less money you could get an actual mountain bike that can handle mountain biking. In the pictures it looks like it was just put together. I have no doubt the bike will be like new, just worried about going with a budget brand. It feels stable on the trails and definitely exceeded my expectations. Don't get me wrong, it's definitely a budget bike ($) but it's great. I've gotten myself down a rabbit hole of good and bad reviews on this bike, maybe this was from previous years with the frame issues but either. Yeah it looks like a great bike! I'm still learning what the ideal components are but I've seen several people talk about Shimano>SRAM which it. Polygons are great. I bought one of their hard tails two years ago and I ride gravel and singletrack, about 75 miles a week and I have had no issues at all. My mate bought a N8 in Australia and he hasnt had any issues. He loves his polygon. Very well priced bike. Polygon Bike Good or Bad? IMO the cheapest hardtail I'd get. Im just getting into the hobby, and i cant afford to spend that much. What. They're genuinely good bikes with good parts for the price. I've seen tons of praise for them. If it fits your needs, ride it! My other bike is a specialised epic evo '21, touted to be an excellent downcountry bike. It does everything better than the t8 but cost more. Polygon are a great brand, from Indonesia. They are definitely at the lower end, but do offer good value for money. I have a Polygon mountain bike and have absolutely no complaints. It's well specd for the price and the frame seems well built and finished. Polygon is from Indonesia and is a recognised brand here in Asia. They make good bikes, on par with Giant IMO. The polygon D5's really are a no-expense mountain bike. They are precisely as crap as you can get before it isn't any good. But they are good &. Polygon bikes any good? Any potential in their frame geometry? There are no bad bikes these days. Really. We can split hairs between, but they. I would have no problem getting another as everything Ive found about Polygon is that they make great bikes! Ive never had a polygon and never seen one in person, but I from what ive heard from others its good brand and low priced for what you get. While I'm not going to put out the power as I did when I was younger or ride as long/far, I'd be really annoyed with a noodley bike. But saving.

1 2 3 4 5